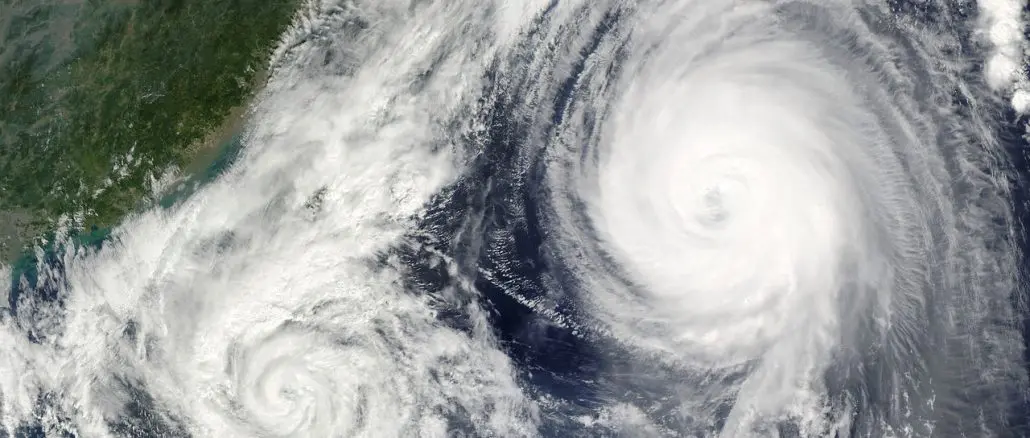

With hurricane season in full force, many UK homeowners with properties in Florida face significant concerns about managing their homes from afar.

As many Floridians and overseas holiday homeowners pick up the pieces from the category three hurricane, Storm Milton, the constant threat of hurricanes in the Sunshine State underscores the importance of proper property management and effective insurance strategies.

Living in Florida presents unique challenges, especially for those in coastal areas where storm impacts can be severe. Hurricane season in the state runs from June 1st – November 30th, and while central Florida experiences less risk, it’s crucial for homeowners to be proactive in safeguarding their properties.

Commenting, Alistair Brown, the CEO of ABI Group, a UK based real estate agency specialising in high-end holiday homes in Central and South Florida, the Caribbean and Europe said: “Managing a home in Florida, while living in the UK, can be daunting during hurricane season. It’s essential for homeowners to understand their options and have a trusted local property manager to help navigate these challenges.

“It’s important for those considering investing in Florida, or already have, to understand the risk in Central Florida is significantly less than those closer to the coast.

“While there is no simple solution, we aim to help clients feel more secure about their properties. Being prepared is key to managing the risks associated with hurricanes.”

There are certain areas where investing in expertise is key, they include:

Local Expertise: Having a knowledgeable local property manager can ease the stress of looking after your property. ABI group is well-versed in the local market and can provide guidance on best practices for maintaining Florida property.

For first time property investors in the state of Florida, it is important to know where the best place to buy within the state is, especially with turbulent weather during the hurricane season which primarily affects coastal resorts and thus can mean higher maintenance bills. The location you go with will determine your long-term financial potential so it’s important to choose wisely.

For those wishing to have an investment property in Florida, think about your rental strategy. If you’re looking to be close to some of the main tourist destinations such as Disney World, consider areas in Central Florida.

Having the right paperwork in place to purchase a property can often be overwhelming. Paperwork can include surveys, land title deeds, disclosure statements, loan agreements, purchase agreements, and much more. Having an expert like those at ABI group, can guide and advise on ways to fast-track the process can reduce the stress while investing.

Insurance Considerations: Insurance policies can vary significantly based on location, and it’s vital to secure coverage well before a named storm. Many insurers stop issuing new policies once a storm is named.

Homeowners should choose insurance providers carefully, as some companies with lower priced policies may not prioritise fair payouts.

Property Inspections: Now is a good time for homeowners to schedule property inspections and renew insurance policies. Regular inspections can help identify vulnerabilities and ensure that the property is prepared for any potential storms.

Alistair concluded: “With the ongoing effects of climate change, it is important for UK residents investing in the Florida property market to be proactive, rather than reactive to secure their assets and key to this is having a local partner on the ground.