Are your retirement dreams in sync with your later life realities? In a world where retirement can seem like a distant dream, Legal & General has delved into the aspirations and actual experiences of UK individuals aged 50 and above.

In a survey conducted with 2,004 UK people aged 50 plus, feeling financially secure and maintaining a pre-retirement lifestyle came out on top when asked what is important – with 94% of respondents agreeing.

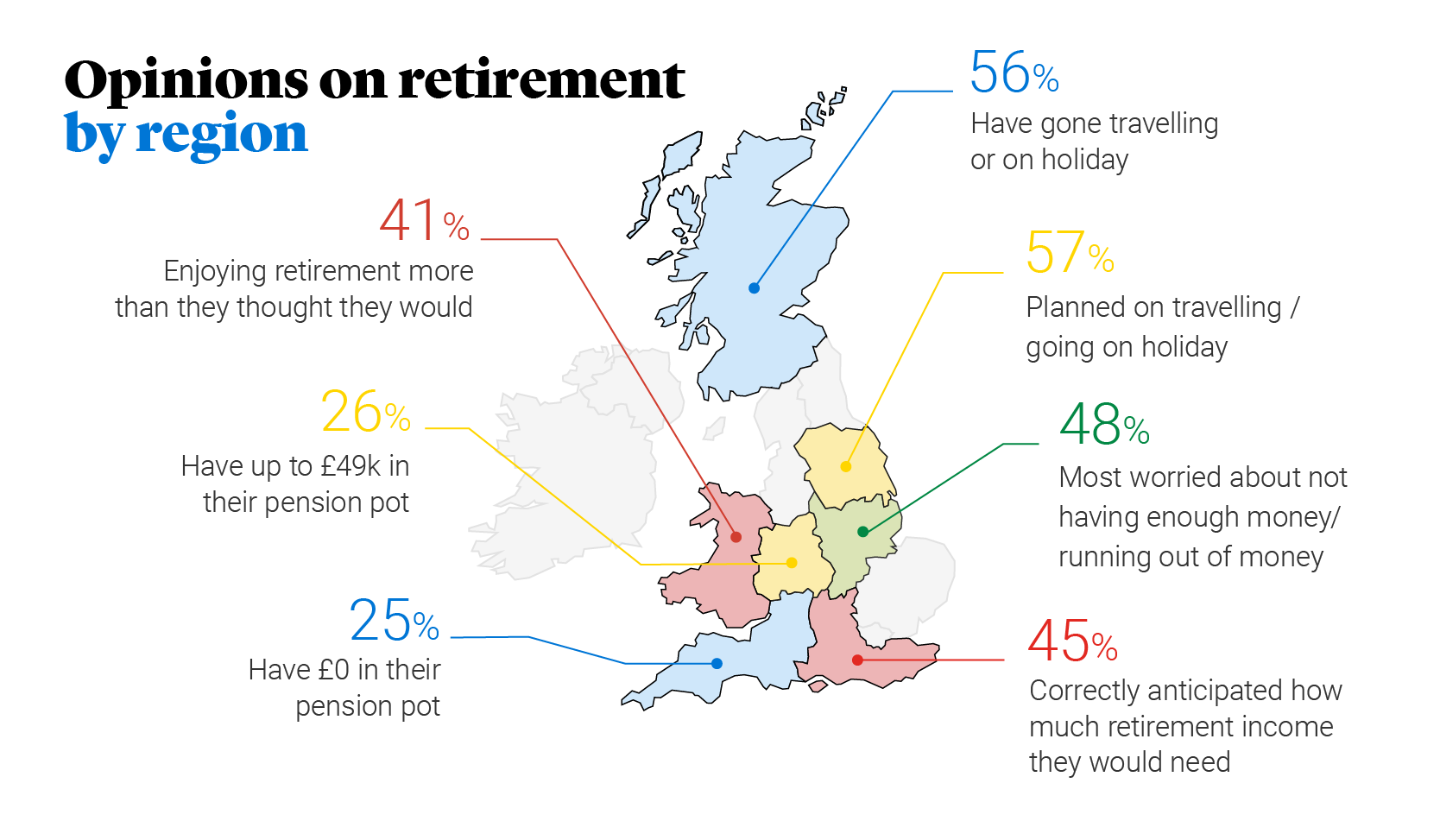

When asked about retirement plans, the survey respondents were eager to travel (52%), spend time on existing hobbies (38%) as well as do some DIY or home renovations (28%).

So how did this work out? Legal & General’s survey suggests that people spend a little more time looking after their families and doing DIY, and a little less time traveling and taking up new hobbies, than they thought they would. Apart from that, everything mostly went as they’d hoped.

However, 41% of respondents said they have ended up needing more money than planned – and 1 in 5 said they needed ‘significantly more’ than anticipated.

In terms of the decisions people make about what to do with their retirement savings, over a third (31%) didn’t go anywhere for advice – the highest-ranking answer – and just over a quarter (26%) spoke to a financial adviser.

With money worries cited as the biggest cause of pre-retirement angst (41%), these findings highlight the importance of seeking financial advice to help people make the right decisions for them, and ensure they have enough money to last a lifetime.

Retirement may seem distant for many, but one day it will be a reality. Lorna Shah, Managing Director, Legal & General Retail Retirement says “there’s a lot you can do to help you live your ideal retirement when you finally get there. Start by imagining it! Sketch out your later life hopes and dreams. Then you can see if you’re saving enough and making the right pension pot choices to support them, and take action if you’re not.

“Of course, in our tough financial times that probably won’t be as easy as it sounds. But even if all that planning’s a bit stressful and confusing, our research shows that it will be well worth doing. Looking at your financial situation, setting later life goals and getting advice on the best way of achieving them are key steps toward a happy retirement.

“So whether you’re looking to spend more time with loved ones, travel the world or just keep up your current lifestyle, our advice is the same: Plan ahead and you can do it.”

For more information, please see here: https://www.legalandgeneral.com/retirement/rewirement/retirement-realities/